We actively co-invest with our fund managers in selected portfolio companies.

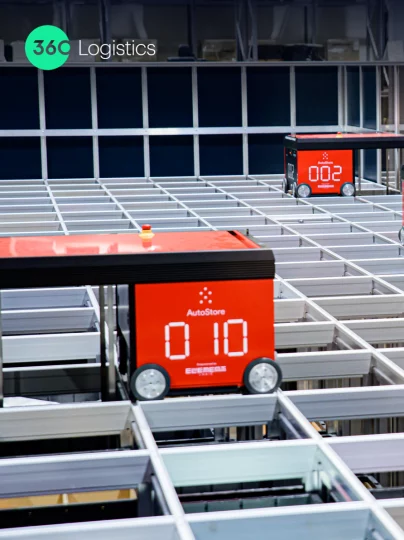

360 Logistics is one of Norway’s leading third-party logistics suppliers (3PL) for eCommerce. Their automated fulfillment center in the heart of Oslo is close to the end customers and enables efficient and environmentally friendly last-mile solutions. By moving the goods to a 3PL that is closer to the end customer, the need for long- distance transport is significantly reduced. 360 Logistics' solutions are an important contribution to developing more sustainable cities. Ferd Impact Investing is co-invested with Dovetail.

Antler is the world’s day zero investor that inspires, enables, and invests in visionary founders everywhere. Founded on the belief that talent is everywhere but opportunity is not, they remove the barriers to entrepreneurship so more people can launch sustainable businesses that solve meaningful problems, drive innovation, and improve lives. They partner with the most early-stage entrepreneurs around the world through their residencies in about 30 cities across six continents—Austin, Berlin, Bangalore, Jakarta, London, New York, Singapore, Stockholm, Sydney, and beyond. To date, Antler have brought more than 1,500 startups into existence that are delivering paradigm-shifting solutions across all industries, with the goal of backing more than 38,000 founders by 2030.

Brim Explorer is a distinguished maritime company operating in Northern Norway and Oslo, offering silent, sustainable, and innovative sea experiences. With a fleet of meticulously designed ships, Brim Explorer prioritises guest satisfaction while minimising its environmental impact. The company's commitment to preserving the natural habitat is evident through their hybrid-electric engines, ensuring minimal noise and vibration, thus preserving the tranquility of the surroundings’ experiences.

Disruptive Technologies AS is a Norwegian technology company headquartered in Lysaker, specializing in the development of small, wireless sensors and robust Internet of Things (IoT) infrastructure. Founded in 2013, the company aims to simplify data collection from physical assets, enabling smarter, more sustainable operations across various industries.

Ditio provides groundbreaking SaaS project management solutions for complex civil construction projects. The solution provides comprehensive tools for time, equipment and inventory management, as well as documentation and reporting, collaboration, communication, transport and logistics. They are developing features that can capture environmental data, allowing their customers to analyse their impact and implement more sustainable construction practices. They aim to help forward-thinking companies understand their projects' environmental footprint, energy efficiency and emissions, giving them the insights to ensure high ESG standards. Ferd Impact Investing is co-invested with Dovetail.

Ignite is a software platform with a clear mission to enable increased profitability, sustainability, and a simpler everyday life within strategic procurement. They transform spend data into insights and results and use AI and conversion enrichments to automatically track and measure CO2 emissions. Ignite empowers their users to take the guesswork out of procurement and surge ahead with clarity and responsible decisions. Ferd Impact Investing is co-invested with Arkwright X.

Kvist Solutions develop a software platform that helps real-estate companies, contractors and consultancies with environmental certification of buildings. Their goal is to make it easier and more efficient to build sustainable and environmentally friendly, facilitating more ambitious sustainability targets. Ferd Impact Investing is co-invested with Arkwright X.

Metizoft AS, founded in 2006 and headquartered in Fosnavåg, Norway, provides software platforms and services promoting sustainable and responsible operations on ships all over the world. The company has the leading solution for documenting hazardous materials onboard ships (IHM) and an advanced system for chemical management. With their new solutions for ESG reporting and life cycle assessment (LCA), Metizoft enables their customers to meet increasing demands for transparency and helps them build a comprehensive environmental strategy. Ferd Impact Investing is co-invested with Dovetail.

Nofence is the world's first virtual fencing system for grazing animals. The technology consists of a solar-powered GPS collar and a virtual boundary. Nofence ensures better utilization of pastures, which enables regenerative agricultural practices ultimately improving soil carbon, rainfall infiltration and soil fertility. Ferd Impact Investing is co-invested with Momentum.

Propely AS is a Norwegian proptech company founded in 2019, specializing in digital property management solutions. Their

platform streamlines communication between landlords, tenants, and service providers, enhancing operational efficiency and tenant satisfaction. By automating tasks such as maintenance tracking, compliance reporting, and internal controls, Propely reduces manual processes and improves data-driven decision-making. Ferd Impact Investing is co-invested with Arkwright X.

Shoreline is a Stavanger-based enterprise SaaS company for the wind industry. The company is providing intelligent simulation and optimization solutions for project development and field operations management for wind energy assets. Shoreline has been deployed by several of the world's largest energy and power companies across assets in Europe, US, and Asia with an initial focus on wind and strong applications across all energy verticals requiring complex scenario planning.

Ferd Impact Investing is co-invested with Ecosystem Integrity Fund.

Wind Catching Systems (WCS) develops a disruptive concept for offshore floating wind energy, with a potential to produce green electricity at a significantly lower LCOE than other floating wind technologies, and at a smaller area. Aibel AS, The Institute for Energy Technology (IFE) and Innovation Norway are key partners in the technology development. Ferd is co-invested in WCS together with North Energy ASA, GM Ventures and Havfond, among others.