About us

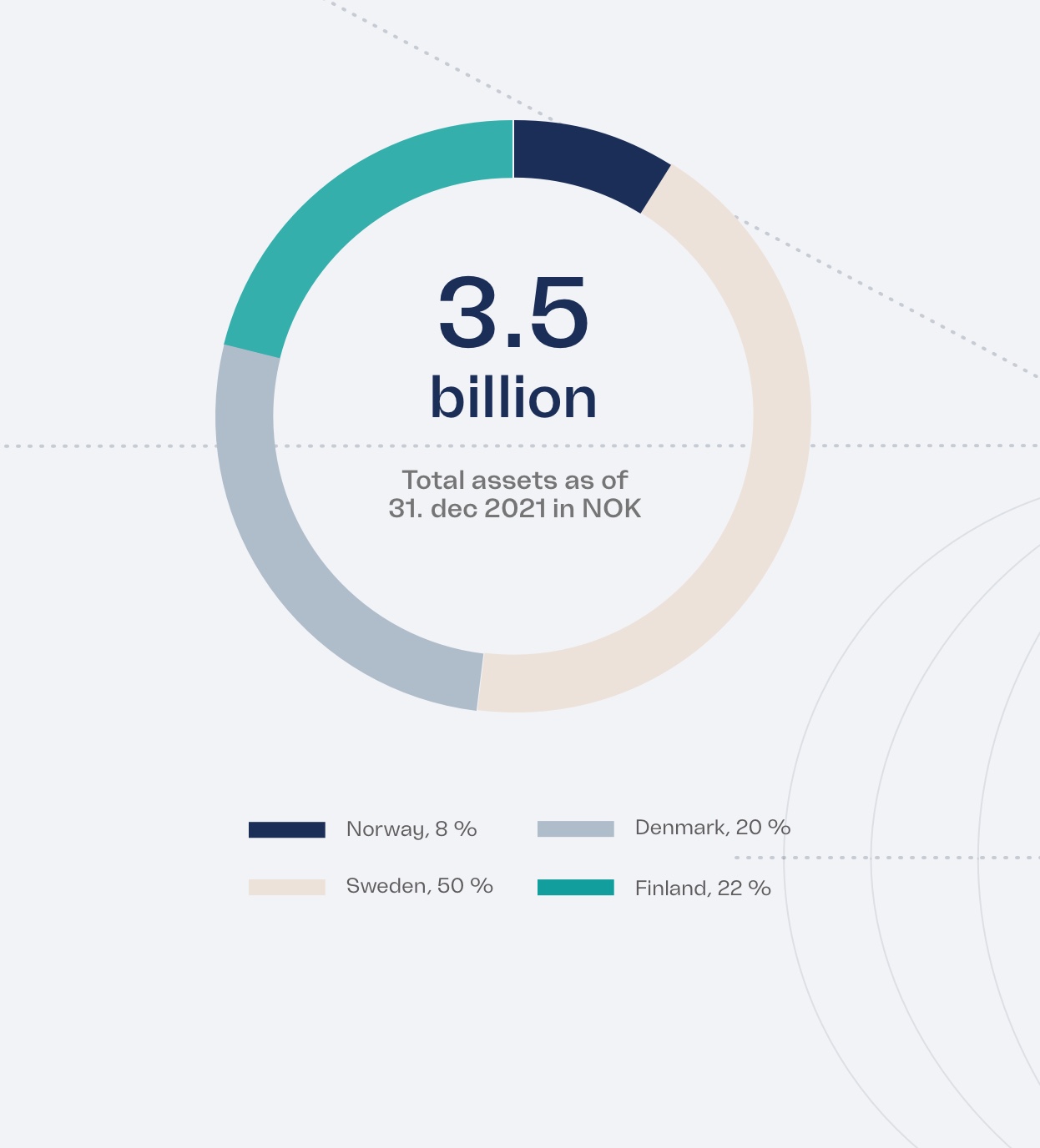

Ferd Invest is an active investor in strong, listed Nordic companies.

We hold a portfolio of investments in up to 25 companies, the majority of which have a market capitalisation of over NOK 15 billion.

Ferd Invest is a financial investor that exercises its ownership through dialogue with companies’ boards and executive management teams.

The portfolio is liquid and flexible, and represents a key tool in Ferd’s ongoing risk management activities.